Your plan for investing

Your Plan for

Investing

Your Investment Plan Is A Foundation

Of Financial Literacy

When you understand the basics of how to effectively apply various financial skills to your day-to-day life you will have achieved the foundations of financial literacy, and be ready to have a successful investment plan.

Your Plan For Investing

To create a successful plan for investing, we recommend that you follow a few core principles of financial literacy. These principles include the following.

Saving Money

First, you must learn how to save regularly to build, and sustain, a margin of safety. Remember, you can’t control the markets, but you can control your savings and financial security. Furthermore, careful spending is just as important as saving, as it’s how you can sustain a lifestyle committed to saving and investing at the same time.

Determining Milestones

Creating milestones for your investment plan isn’t about crossing a finish line, it’s about ensuring you’re on track. So, be sure to set 1-year milestones (around building a margin of safety) and 5-year milestones (around building investments).

If you’re having trouble with creating these milestones, give our Annual Physical Investment a try. This will help you get some ideas of what successful milestones can look like based on your specific investments. When you assess your milestones, be sure to do them individually, not blanked across all of your accounts; this will help you better understand where the influences within your portfolio exist.

Create An Investment Pledge

If you’re not willing to write down and commit to your goals (we call this a pledge), then you might not be ready to succeed in investing. We recommend that you write a pledge that highlights your commitments around monthly savings, and 1 & 5-year milestones, and acknowledges who will be your accountability partner along the journey. This pledge is the official statement of your commitment to success, so don’t take it lightly.

Ready To Confidently Engage With Your

Financial Investments?

If you’re ready to change your relationship with money and better

understand the practical tools of investing, sign up to take the course today.

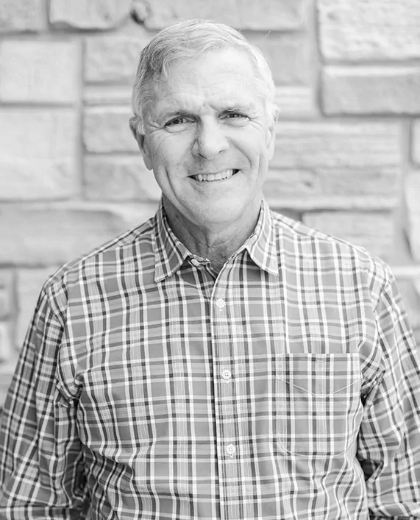

Why Beginning Investors Are

Believers In Objective Measure

Experience

With nearly 50 years of financial experience, the Objective Measure team brings access to knowledge that others pay big dollars for.

Non-Profit Status

Investing is not meant to make you rich, but a purposeful activity meant to enrich your life. When was the last time you asked yourself, how might I enrich my life if I learned to invest confidently?

Roadmap

When you’re a part of the Objective Measure ecosystem, you get access to your financial success roadmap. This means you step through education & training to improve your thinking. From improved thinking to empowerment. From empowerment to changed behavior. And from changed behavior to different results.

Objective Measure Classroom attendees say the nicest things:

thank you for sharing this knowledge”

Stay Connected

Keep up to date on the latest from Objective Measure: