Financial Momentum Building Tools

We provide clear, trustworthy, and free financial tools, empowering individuals to take control.

Investment Essentials Course

Investment Essentials is a self-paced course that helps everyday people start seeing themselves as investors. Without the jargon, hype, or hidden agenda. Learn the timeless principles that drive long-term success and gain the confidence to invest with clarity.

The Able App

Able gives you a clear, personalized view of your financial health, along with expert-informed insights to help you make confident decisions. Designed for everyday earners, it brings your full financial life into one place with guidance you can trust.

Financial Insights

From blog content to newsletters and live events, we're constantly creating relevant, real-world education from some of the brightest minds in finance. All curated to help you grow in confidence and capability every step of the way.

Our Three Core Principles

No Agenda.Just Education.

We're a nonprofit built to inform, not to sell, pressure, or profit from your decisions.

Trusted Tools,Backed By Experience

Over 50 years of investment expertise behind every resource we create.

EmpoweringEveryday Progress

Helping real people take meaningful steps toward financial confidence.

Addressing the Gaps in Financial Solutions

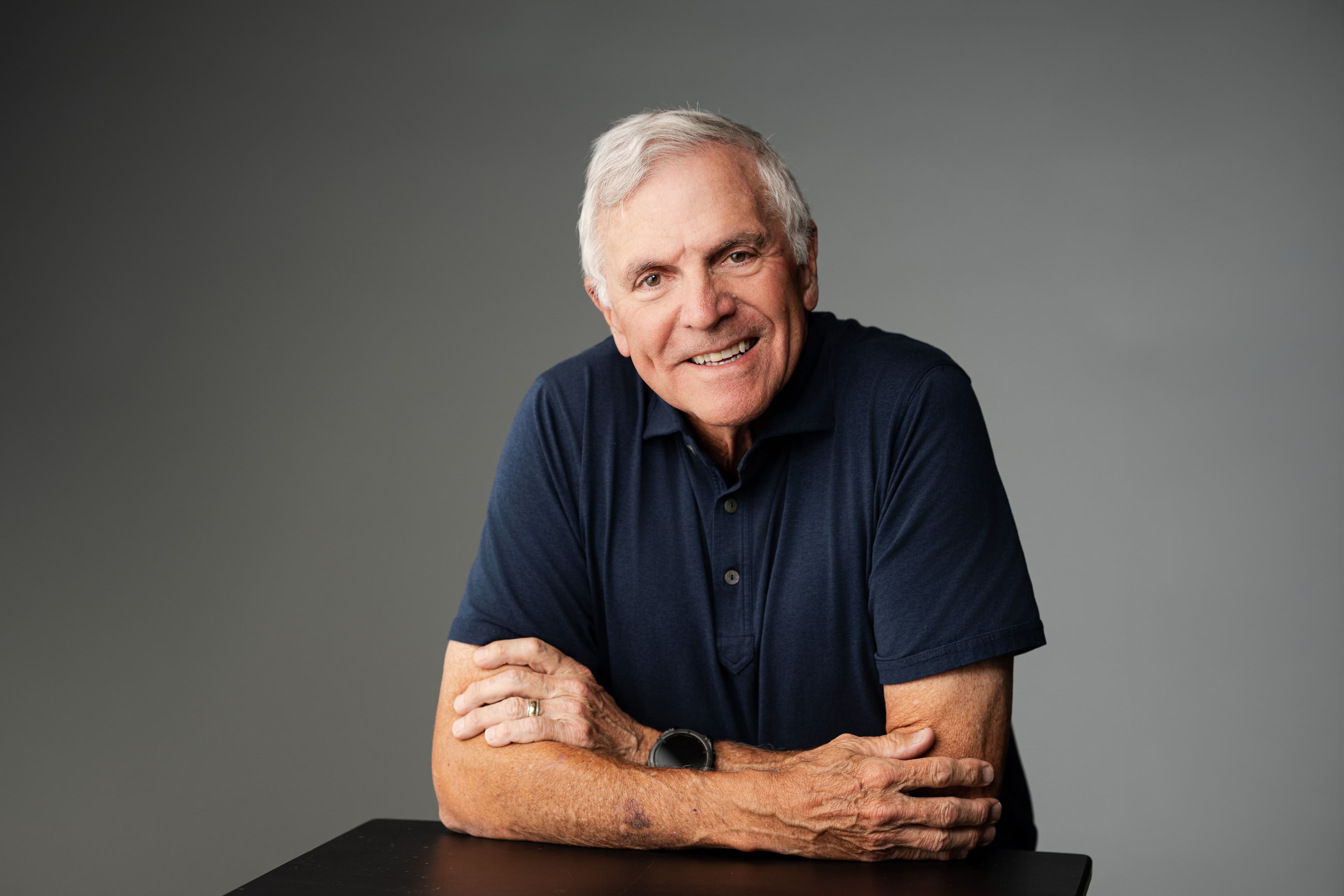

A Mission Born From Experience

Fred Martin founded Objective Measure so that everyday people can start seeing themselves as investors. Making financial clarity, confidence, and lasting progress accessible to everyone.

Our bold goal: empower 20 million people in 20 years to change their financial behavior through honest, expert tools and no-pressure education.

Know Your Financial Health—And What to Do About It